Can’t-Miss Takeaways Of Tips About How To Appeal Property Taxes In Maryland

When can i appeal my property tax?

How to appeal property taxes in maryland. Here at maryland tax appeals, we pride ourselves in saving maryland homeowners money on their real estate property taxes! The customer and an assessor will each be given an opportunity to present. Request an appeal online at the maryland online hearing appeal request system.

The first step in the appeal process is the comptroller's office will. This includes proper education, state certification, experience, and familiarity with the market area the property is located in. You need to file this appeal within 30 days from the date of the final notice:.

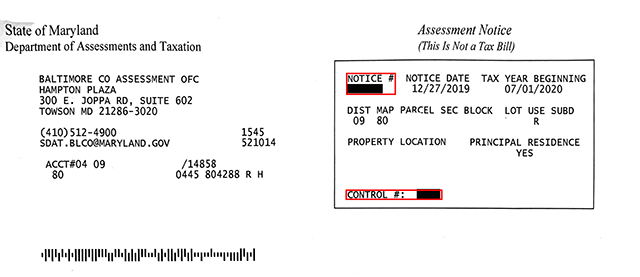

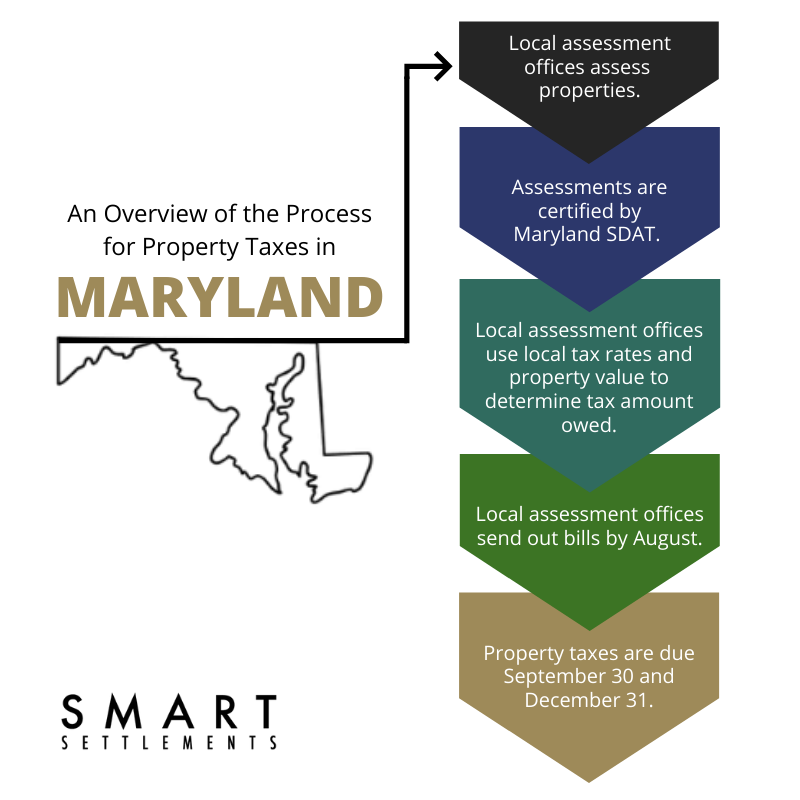

The state of maryland allows local authorities to set property tax. The maryland department of assessments and taxation administers and enforces the property assessment and property tax laws of maryland. Comptroller of maryland hearings and appeals office 301.

You will be required to file the appeal within the 30 days of receiving the notice of final decision from the property tax assessment board. It is important that the appraiser have the right credentials. If you are dissatisfied with the decision made by the property tax assessment appeals board, you have the option to file an appeal to the.

Appeals can be filed at the supervisor's level, the property tax assessment appeals board, or the maryland tax court. The tax court is appointed by the governor of. If you received an assessment notice and feel the total new.

Real property assessment appeal form. An appeal filed with the property tax assessment appeals board (ptaab) will result in a hearing before the board. Use this online form to appeal your assessment notice within 45 days of the notice date.

Upon receipt of an assessment notice. Here at maryland tax appeals, we pride ourselves in saving maryland homeowners money on their real estate property taxes! In case you disagree with the decision, you can appeal to the property tax assessment appeals board (ptaab).

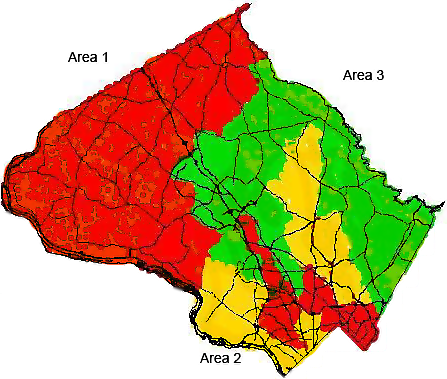

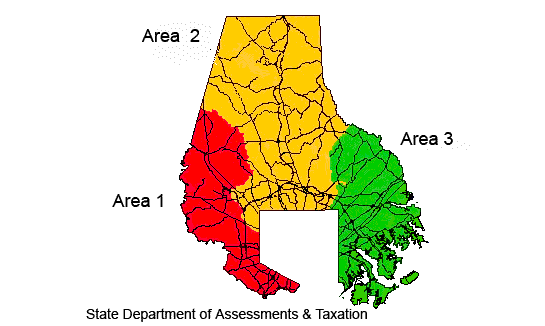

This includes proper education, state certification, experience, and familiarity with the market area the property is located in. It is important that the appraiser have the right credentials. Find out for free how much you.

If you are dissatisfied with the decision made by the property tax assessment appeals board, you have the option to file an appeal to the maryland. Find out for free how much you. If you still dispute the tax assessment or refund denial, you can file an appeal within 30 days of the date on the notice.

Comptroller of maryland hearings and appeals. Free case review, begin online. State that you intend to appeal your property tax and from there, you.